Parag Kukreja

Outstation Travel Claim Form Name: Designation (Faculty / Staff / Student): Purpose of Travel: Source of Funding (Institute's Funds/PDA/Research Project/Others, please specify): Support i.e. Accom., hospitality etc. Received from Other Sources (please certify): Travel Approved by (please mention approval document- e-mail etc.): Advance Drawn. Initial allowance capital consumption allowance cash allowance travelling allowance daily allowance Charge allowance tax allowance outstation cheque overtime allowance Compassionate allowance Clothing allowance conveyance allowance halting allowance indian army allowance contraction allowance leave without allowance compensatory local allowance.

Articles deals with Taxability of House Rent Allowance , Children Education Allowance, Hostel Allowance, Transport Allowance, Outstation Allowance, Under Ground Allowance, Traveling Allowance, Daily Allowance, Conveyance Allowance, Helper Allowance, Uniform Allowance and Academic Allowance.

House Rent Allowance – Section 10(13A) Rule 2A

House Rent Allowance received by any employee shall be exempt to the least of following:

a.) House Rent Allowance Received

b.) Rent Paid over 10% of Salary for the Relevant Period.

c.) 50% of Salary in Metropolitan Cities/40% of Salary in Non-Metro Places.

Personal Allowances | |||||||||

| 1.) | Children Education Allowance | a.) Any Children Education Allowance received shall be exempt upto Rs.100 per month per child upto Two Child | |||||||

| b.) Exemption Shall be allowed irrespective of Expenditure Incurred | |||||||||

| c.) Child shall include step child & adopted child but will not include grand child | |||||||||

| d.) Exemption shall not be allowed for third child even if it is twins after birth of one child. | |||||||||

| 2.) | Hostel Allowance | a.) Any Hostel Allowance received to meet Hostel Expenditure of Children shall be exempt upto Rs.300 per month per child upto Two Child | |||||||

| b.) Other Conditions remain same as mentioned in Children Education Allowance in Point No.(b), (c), (d) | |||||||||

| 3.) | Transport Allowance | a.) Any Transport Allowance received to meet expenditure for purpose of commuting between place of residence & place of duty shall be exempt upto Rs. 1600 per month (Only up to A.Y. 2018-19) | |||||||

| b.) Transport Allowance granted to Physically Handicapped persons shall be exempt upto Rs. 3200 per month. | |||||||||

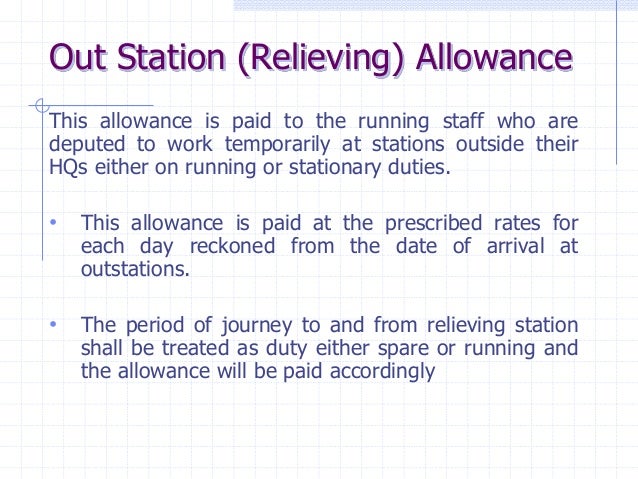

| 4.) | Outstation Allowance | a.) Such Type of Allowance is granted to employees working in any transport system for the purpose of meeting Personal Expenditure | |||||||

| b.) Any Such Allowance received shall be exempt to the least of following: | |||||||||

| (i) 70% of Allowance received | |||||||||

| (ii) RS.10,000 per Month | |||||||||

| 5.) | Under Ground Allowance | a.) Such Type of Allowance is granted to employees working in uncongenial, unnatural Climate in underground mines. | |||||||

| b.) Any Such Allowance received shall be exempt upto Rs.800 per month. | |||||||||

Official Allowances | |||||||||

| 1.) | Travelling Allowance | a.) Such Type of Allowance is granted to meet cost of travel on tour or transfer of employees & shall be exempt from Income Tax | |||||||

| b.) It shall also Include any amount paid in connection with transfer,packing,transportation of person effects. | |||||||||

| 2.) | Daily Allowance | a.) Such Type of Allowance is granted to meet ordinary Daily Charges on account of absence from normal place of Duty & shall be exempt from Income Tax | |||||||

| 3.) | Helper Allowance | a.) Such Type of Allowance is granted to meet expenditure incurred on Helper provided Helper is engaged in performance of duties of an office & shall be exempt from Income Tax. | |||||||

| 4.) | Uniform Allowance | a.) Such Type of Allowance is granted for purchase of Uniform or maintenance of uniform for wear during performance of duties of an office & shall be exempt from Income Tax. | |||||||

| 5.) | Academic Allowance | a.) Such Type of Allowance is granted for encouraging academic research and training pursuits in educational & research institutions & shall be exempt from Income Tax. | |||||||

Note:

1.) Salary for the purpose of Calculation of Exemption of House Rent Allowance shall be Retirement Benefits salary which Includes Basic Pay,Dearness Allowance,Commission if it is paid as fixed percentage of the Turnover basis as decided in Gestetner Duplicators Pvt. Ltd. vs CIT.

2.) If there is any change in House Rent Allowance,Rent Paid, Salary or the place of Posting during the Year, Separate Calculation for the purpose of Claiming exemption shall be made for each change.

3.) Exemption for House Rent Allowance shall not be allowed if no expenditure is incurred on payment of rent however there is no such condition that an employee should not own house, If an employee is residing in rented property, exemption shall be allowed.

4.) The Official Allowances received for the purpose of meeting official expenses are exempt from the Income Tax Act,1961. However If any Savings is made i.e. EXPENDITURE INCURRED IS LESS THAN THE AMOUNT RECEIVED Then difference shall be taxable under the head Salary.

5.) Exemption for Personal Allowances shall be allowed irrespective of Expenditure Incurred.

(Republished with Amendments)

Outstation Allowance Meaning

One of my friend works in an International BPO in Ahmedabad. He's basically from Vadodara. Now his company is providing him Rs.4,000/- as 'OUT STATION Allowances'.

So he wants to know that whether these allowances will be included as part of his Annual CTC package?? In other words, will these allowances will be a part of Gross salary structure??

Please give me a feedback on this query.

Rgds,

Harshavardhan

From India, Ahmadabad

From India, Ahmadabad

outstation allowances or site allowances are income and subject to I.Tax purview. It may be treated as part of CTC, however, this allowance will be discontinued once the employee return to the base. Hence it is not fixed. In sime organisations, they don't include these allowances in CTC.

outstation allowances or site allowances are income and subject to I.Tax purview. It may be treated as part of CTC, however, this allowance will be discontinued once the employee return to the base. Hence it is not fixed. In sime organisations, they don't include these allowances in CTC.Pon

From India, Lucknow

From India, Mumbai

Drivers Outstation Allowance

Outstation Allowance Meaning

Add the url of this thread if you want to cite this discussion.

Outstation Allowance Policy

Outstation Allowance Exemption